So, to attract the customers, the product’s price needs to be set so that it works for both parties the company and the customers. If in the eyes of the customer, the value of the product is lesser than the price charged, it is reasonably possible that the sale would not happen. The customers or consumers see the product’s value concerning the price they are paying for it.For using these strategies, the product’s unit price should be adequately derived prior so the company could understand its position on the pricing techniques. read more are concerned with entering a new market. Various marketing techniques such as low-cost or predatory pricing Predatory Pricing Predatory pricing is a pricing strategy in which the prices of products and services are set at such a low level that it becomes nearly impossible for others to compete in the existing market and forces them to leave.Following are some critical advantages of pricing a product: The unit price helps the company to adequately market its product.

It refers to any commodity or combination of goods that might be used in place of a more popular item in normal circumstances without affecting the composition, appearance, or utility. It depends upon multiple factors such as the brand value of the product, selling strategies, competitive or substitute products Substitute Products Any alternative, replacement, or backup of a primary product in the market is referred to as a substitute product. The profit portion is generally added to the extent a company sees its product that would create value for the consumers. read more or the total cost incurred to make the product available to sell, a profit portion is also added to arrive at the product’s final price or service. These are directly related to the products manufactured.Īpart from including the cost of sales Cost Of Sales The costs directly attributable to the production of the goods that are sold in the firm or organization are referred to as the cost of sales. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. We divide the variable cost mainly into raw material, labor, and overhead costs Overhead Costs Overhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. These are fixed for the product and increase or decrease in line with the production of a unit.

Fixed Costs: Fixed costs Fixed Costs Fixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon.

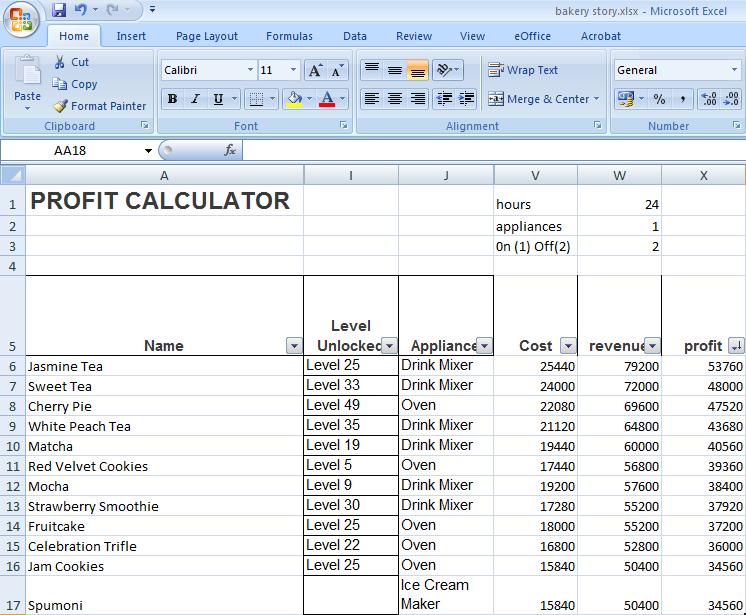

The cost of the product mainly consists of the following heads: read more indicates the cost of producing the final products when it is readily available to be sold or transferred. It is calculated by adding fixed and variable expense and dividing it by the total number of units produced. The unit cost The Unit Cost Unit cost is the total cost (fixed and variable) incurred to produce, store and sell one unit of a product or service.

0 kommentar(er)

0 kommentar(er)